geothermal tax credit canada

The federal governments plan to introduce a tax credit for carbon capture utilization and storage CCUS technology hit the top tier of the Canadian climate agenda this week after more than 400 climate scientists and other academics wrote to Deputy Prime Minister and Finance Minister Chrystia Freeland urging her to drop the idea. Receive upto a 30 tax credit in USA and other.

Net Zero Report Card How Future Friendly Are Canadian Provinces Corporate Knights

Green Energy Equipment Tax Credit The Government of Manitoba currently offers a tax credit for geothermal heat pump systems 75 15 and solar thermal energy systems 10.

. Todays ground source heat pumps are capable of delivery outstanding COP. Offer not available in Quebec. Percentage depletion may be deducted even after the total depletion deductions.

Pre Sized Easy to Install DIY Geothermal Heat Pump Kits Info. Percentage depletion is a method of depletion applied to most minerals and geothermal deposits and to a more limited extent oil and gas. The cultural industries printing tax credit has been extended until the end of 2024.

Solar Panel Rebate Program pending Efficiency Manitoba announced in 2019 they will have a permanent solar panel rebate program in place by 2022. The community enterprise development tax credit has been extended until the end of 2022. Geothermal ground source heat pumps have grown in popularity through Canada and USA.

Our mission is to accelerate the creation of a sustainable energy system in Canada by producing and communicating the countrys most useful and comprehensive sustainable energy information. And as society continues to put money and resources into addressing the issue top renewable energy companies in Canada have made significant investments in clean energy. The Contractor Reward Program card is the property of Lowes Canada.

2 Stage Heat Pump. The maximum credit amount that can be claimed by an individual for the small business venture capital tax credit has increased. The book publishing tax credit has been made.

Atlantic investment tax credit of 10 of the cost of prescribed energy generation and conservation properties. We reserve the right to discontinue. With climate change being one of the most talked-about issues of our generation renewable energy stocks are becoming an increasingly important part of any investors portfolio.

Percentage depletion is deductible at rates varying from 5 to 25 of gross income depending on the mineral and certain other conditions. The use of Lowes Business Account or Lowes Accounts Receivable offer are subject to credit approval by Synchrony Financial Canada. Excludes Lowes Consumer Credit Card Lowes Project Card Accounts and all Lowes US Credit products.

The purpose of this Chapter is to describe these incentives and the criteria necessary to benefit from them. Our heat pumps have both stage compressors and ECM variable speed fans. Responsibility for administering the tax incentives is shared between the CRA and Natural Resources Canada NRCan.

Solar Tax Credits Incentives And Solar Rebates In Canada

Incentives Grants Geosmart Energy

Canadian Tax Credits For Energy Efficient Homes

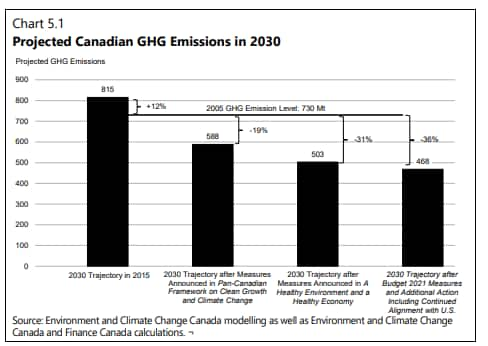

Canada S Fy2021 22 Budget Includes Big Green Investments Indication Of Additional Ghg Emissions Cuts Ihs Markit

Canada S 170 Ton Carbon Price Makes Heat Pumps Financial Winners Cleantechnica

Canada S Fy2021 22 Budget Includes Big Green Investments Indication Of Additional Ghg Emissions Cuts Ihs Markit

Put More Money In Your Pocket Create Jobs In America And Help Fight Climate Change By Going Solar The Resident Home Maintenance Energy Efficient Homes Solar

Canada S Fy2021 22 Budget Includes Big Green Investments Indication Of Additional Ghg Emissions Cuts Ihs Markit